Travel

Travel  Travel

Travel  Creepy

Creepy 10 Haunted Places in Alabama

History

History Top 10 Tragic Facts about England’s 9 Days Queen

Food

Food 10 Weird Foods Inspired by Your Favorite Movies

Religion

Religion 10 Mind-Blowing Claims and Messages Hidden in the Bible Code

Facts

Facts 10 Things You Never Knew about the History of Gambling

Weird Stuff

Weird Stuff 10 Cool and Creepy Facts about Collecting Tears

Humans

Humans The Ten Most Lethal Gunslingers of the Old West

Misconceptions

Misconceptions 10 Phony Myths and Urban Legends That Just Won’t Die

History

History 10 Amazing Roman Epitaphs

Travel

Travel Top 10 Religious Architectural Marvels

Creepy

Creepy 10 Haunted Places in Alabama

History

History Top 10 Tragic Facts about England’s 9 Days Queen

Who's Behind Listverse?

Jamie Frater

Head Editor

Jamie founded Listverse due to an insatiable desire to share fascinating, obscure, and bizarre facts. He has been a guest speaker on numerous national radio and television stations and is a five time published author.

More About Us Food

Food 10 Weird Foods Inspired by Your Favorite Movies

Religion

Religion 10 Mind-Blowing Claims and Messages Hidden in the Bible Code

Facts

Facts 10 Things You Never Knew about the History of Gambling

Weird Stuff

Weird Stuff 10 Cool and Creepy Facts about Collecting Tears

Humans

Humans The Ten Most Lethal Gunslingers of the Old West

Misconceptions

Misconceptions 10 Phony Myths and Urban Legends That Just Won’t Die

History

History 10 Amazing Roman Epitaphs

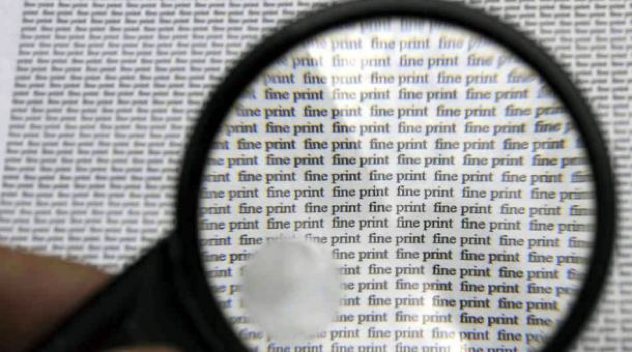

10 Ways The Bank is Stealing From You

People are getting smarter these days. At a time of increased financial concern the world over, it’s no wonder we are always looking for ways to save a buck. But are we really cognizant of the trickling tap effect? Can we afford to be shortsighted when it comes to disappearing money?

The following list will dive into brief synopses of the little secrets of financial institutions. Keep in mind that I am not receiving compensation from any financial institution or brokerage. This is a product of my experience and research. These points express my personal observations and are intended to be used for educational purposes.

We may not think of the bank as a place to spend money, but tellers are actually trained to make sales. Profitability, as with any successful venture, is the intrinsic dialect of the system. In this current low-rate ecosystem, profit by interest alone is not enough. Special and limited time offers are marketing tools used to get you inside. The immediate problem here is they “forget” to tell you how promotional rates will eventually change. On a trip to the bank you won’t have trouble finding motivated salespeople. Low opening rates, reward point systems and extended payment periods are just a few of the incentives they use. But unless you are an astute money manager, keeping track of interest and fees is probably not part of your day planner. Everything a bank offers you needs to be looked at more closely to determine whether or not you are getting ahead. All too often, incentives are well-planned gimmicks.

You probably recall the original Willy Wonka & the Chocolate Factory (1971) film scene where a stranger in the street appears at the factory gate as Charlie stands wistfully looking in. “Nobody ever goes in…and nobody ever comes out”, he solemnly warns.

While it may be quite feasible to change banking institutions, I can’t help using this closed environment illustration. Since bankers and tellers have to make certain numbers to keep their jobs, losing clients and business is out of the question. To meet quotas, they are pressured to be aggressive in selling loans and investment vehicles. No disrespect to these licensed bankers and tellers however, as the services they sell can be helpful to individuals as well as businesses. But credit cards are too accessible these days. For young people and those in low income brackets, credit and loans are an easy out. They fail to realize how expensive this is though, and inability to keep up results in poor credit down the line. And it doesn’t just disappear by tapping the Staples “easy” button.

You may not be paying off debt as fast as you think. This is usually where people begin to really listen up. On credit cards, you pay high rates of interest on large purchases, and when it comes to paying that debt off, you start from the bottom up. The smallest debts carrying the lowest rates will be erased first. This principle is called negative order of payment. Furthermore, the bank will issue you credit cards no matter if you have $100 or $10,000 in your checking account. These values represent a liquid asset that could be there today and gone tomorrow. Providers know if there’s a card in your pocket you will use it, and they will take their liberties in optimizing the interest you pay. Some bankers have even admitted their interest rates frequently fluctuate, despite what a card agreement may state.

Not all banks charge for the service of online bill paying and/or money transfers. However, it is advisable to ask your bank about this. It could be another contributor to the cannibalization of your checking account. Convenient online bill payment is one of the many great features provided by banks. If you’ve been paying bills online, be sure to check your transaction history or call your bank. Payments can lead to a significant commission downside. Typical bill payments include phone, internet, cable, hydro, heating and charitable donations. If you are being charged for this, try negotiating it or ask if there is a limit issue. Keep in mind you will be charged for wire transfers to different accounts as well.

If your bank ever informs you of an account upgrade, promotion or offering, always read to the end of the paperwork. For example, if offered a “free” overdraft protection limit, make sure there is no initial fee. As well, every time you close an account there will be a charge. If you use debit cards a lot, but neglect paying attention to your statements, you might be in for some service charge surprises. Some banks are good about this and will promote you to a higher transaction limit. For this there will be a nominal fee, but you will no longer pay for each additional card use. Of course, the best solution of all is to carry cash and only use debit or credit in a pinch.

This is why you should always shop around and ask the right questions before selecting a new deposit account, credit card, line of credit, mortgage, loan, etc. For basic accounts, you could be looking at charges for general maintenance, minimum account balance, online banking, large cash deposits, and teller fees. Not to mention everything else we’ve already come across. With recent new regulations on banks and lenders, some charges are now illegal. This forces banks to stretch their imagination a little, raising other fees or implementing new ones. All good companies innovate, as you will often hear in the news surrounding markets leaders. Why would your bank be any different?

Most traditional bank accounts offer extremely low interest rates. Commonly people leave varying sums of money in checking and savings accounts for years. These funds may in fact depreciate with time as a result of inflation. In this we learn a valuable concept which I like to refer to as stagnation. The interesting thing here is that that inflation is virtually unperceived and yet it impacts everyone year after year. This is a classic example of capital decay, an intrinsic downfall of stagnant cash. Letting your money sit in a bank account is like driving your first car 10 years later. At first it seemed cool, but now it’s begun to lose its appeal and value. One of the things banks probably won’t tell you is that the decent promotional rate on your savings account will be lowered after a certain time.

As I’ve previously alluded to, banks act like any traditional business in the sense of profitability, sales and client base. These considerations are put far before your best interests as a customer. Secret fees, unannounced interest hikes and manipulated credit rates should make you suspicious enough to do your due diligence. Good news is that online banking has made keeping an eye on account activity a lot easier. If you ever encounter suspicious costs, go to the bank and ask for full disclosure. Take your liberties, keeping in mind that as a customer you have the benefit of the doubt. As a further step, you may try contacting a branch manager. The topic of this section gives me reason enough to urge you…read the full agreement whenever you sign up for a service. Never stand between the bank and a sack of money. You won’t realize it slowly shrinking.

If you are a college student reading this, I advise you to be careful regarding what I consider the next generation push. Many universities are working with banks to incorporate ATM-compatible student ID cards. Students are now set up for the double-barrel effect of both high credit and loan debt. While Universities will negotiate for the most favorable setup, they offer little accountability for students’ spending patterns. Meanwhile America is wondering why students are coming out of post-secondary in so much debt. The math is really quite simple. Banks know a percentage of students will be long-term customers, and they also know they will provide many years of high-interest debt repayment. There’s no alternative here; avoid the credit grab. The same goes for those with current long-term debt. Every month you owe interest on interest and gravity has taken hold of your principle payments.

A lot of online brokerages offer much lower fees for trading stocks, bonds, mutual funds and ETFs than any bank would dream of. Along with this, new and improved investment possibilities are starting to appear. Canada, for example, has recently introduced the Tax Free Savings Account (TFSA), a limited contribution vehicle in which capital gains are nontaxable. Add this to RRSPs and other registered accounts, and the capital equation changes. By limiting what you stash in the bank, you can make your money work harder while dealing with the institution less. For any kind of trading or long term investment, the going rates will cost you a fortune. Luckily with the rise of discount brokerages, we can smile a little more when it’s time to take profit.

Even for the very wealthy, saving money and avoiding charges is top priority. Millionaires and tycoons know the ins-and-outs of financial institutions and are successful money managers. There’s nothing stopping you from doing the same. This dissertation takes a look at how banks have a knack of making our money slowly disappear. But as we’ve discussed, there are ways to minimize the damage. You can start to take action right away by utilizing some of the guidelines I have included below. The longer you wait, the more your bank is stealing from you.

Closing tips and suggestions:

Always ask your bank questions

Always read disclosure statements

Try to maintain the minimum account balance

Know the steps to avoid overdrawn fees

Find out what’s billable and what’s not

Make largest debts first priority

Read your transaction statement regularly

Make use of registered investment accounts

Ask a financial adviser about better options