History

History  History

History  Movies and TV

Movies and TV 10 Movie Adaptations That Ruined Everything for Some Fans

History

History 10 Dirty Government Secrets Revealed by Declassified Files

Weird Stuff

Weird Stuff 10 Wacky Conspiracy Theories You Will Need to Sit Down For

Movies and TV

Movies and TV 10 Weird Ways That TV Shows Were Censored

Our World

Our World 10 Places with Geological Features That Shouldn’t Exist

Crime

Crime 10 Dark Details of the “Bodies in the Barrels” Murders

Animals

Animals The Animal Kingdom’s 10 Greatest Dance Moves

Movies and TV

Movies and TV 10 Box Office Bombs That We Should Have Predicted in 2025

History

History 10 Extreme Laws That Tried to Engineer Society

History

History 10 Wars That Sound Made Up (but Absolutely Happened)

Movies and TV

Movies and TV 10 Movie Adaptations That Ruined Everything for Some Fans

History

History 10 Dirty Government Secrets Revealed by Declassified Files

Who's Behind Listverse?

Jamie Frater

Head Editor

Jamie founded Listverse due to an insatiable desire to share fascinating, obscure, and bizarre facts. He has been a guest speaker on numerous national radio and television stations and is a five time published author.

More About Us Weird Stuff

Weird Stuff 10 Wacky Conspiracy Theories You Will Need to Sit Down For

Movies and TV

Movies and TV 10 Weird Ways That TV Shows Were Censored

Our World

Our World 10 Places with Geological Features That Shouldn’t Exist

Crime

Crime 10 Dark Details of the “Bodies in the Barrels” Murders

Animals

Animals The Animal Kingdom’s 10 Greatest Dance Moves

Movies and TV

Movies and TV 10 Box Office Bombs That We Should Have Predicted in 2025

History

History 10 Extreme Laws That Tried to Engineer Society

Top 15 Tips For Saving Thousands On Your Bills

Saving money is the hot word at the moment as the world economy gulps for air. Here I give tips on how you could save thousands by making a few changes to your home and lifestyle. The items are listed in no particular order, and the amounts I personally saved by trying these tips is listed at the end of each segment. Enjoy!

Holidays are often seen as a necessity, but luxury holidays can work out more expensive than they are worth. Traveling to other countries for your holiday can be full of hidden costs, such as airport taxes, insurance, and even the price of a passport, so one thing to consider is just how far do you need to go for have a few weeks of fun?? At the bottom end of the scale, camping holidays can be enjoyed for the price of a tent and a food budget, and a well planned trip could mean you are waking in a new location every day. Similarly, consider hiring a camper or motor-home – and take a tour of the wilderness. Holidaying in foreign parts may still carry a note of prestige, but who needs prestige when you’re broke? Average yearly saving (£): Over £2,000 ($3,000).

Buying ‘New’ costs more, and even more so when considering buying cars. A car can lose up to 50% of its worth in just 12 months, so the second-hand car market is ripe with good quality almost-new vehicles. At the bottom end of the market, a good car may cost as little as £1,000 and could be just as comfortable, reliable and economical as a brand new equivalent. The second-hand hard goods market is also awash with good quality gear. Online auction sites are by far the best places to buy gifts and gadgets at a fraction of the cost of their retail counterparts. For example, a one-week-old computer processor was found for just £90 on EBay – saving £60 – £80 on the price of a brand new one. Charity shops can be gold mines for clothing, drapes, toys and dvds, and because charity shops almost always insist on goods being of the best order, whole outfits can be bought for next to nothing. Average yearly saving by not buying new (£): Unlimited.

Many items have a higher price tag even though they may be carbon copies of other brands; simply because they have a popular label. Many motor manufacturers rebrand imported products to sell the same thing for a higher price. Many clothing manufacturers do the same. So if you can swallow your vanity and shift the ego, there really is no need to wear a label in order to look smart. If you must do, why not just buy a box of sew-on labels and do it yourself! On the shopping front, you may have to ask why you always buy Pepsi when multipak cola feeds the same need for less? Ok, so it might taste better, but it also costs… Again, if you must be suckered into wearing named brands, there are many places which sell the same things for less; and charity shops always have a nice selection of pristine labels on offer. Average yearly saving (£): £250 ($380).

The second most expensive single item on this list is a wedding. Weddings happen to most people, and most have to save for years to get what they want. However, there are always alternatives. One way would be to organize your own wedding using one of the many priests in your area. For example, I asked a Shaman to marry myself and my wife-to-be in a special clearing by a river; I created my own vows; and the whole thing came to under £400. There are many people willing to marry folks for the fraction of the price of a church service, and getting married on a beach, or in a forest – or having a themed wedding – may prove much more memorable and special. Collective saving over a church wedding (£): Over £2,000 ($3,000).

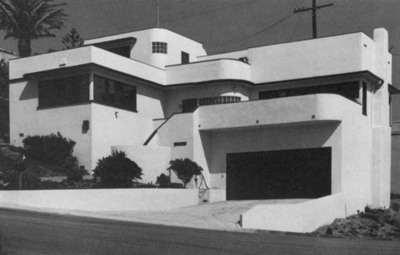

Perhaps the most controversial item on this list is the Rent vs Mortgage argument. In a lot of cases, renting can be as low cost as getting a mortgage and comes with a number of benefits. Firstly, you won’t owe £150,000 to be payable over 40 years! This means these debts wont be passed on to your next of kin should you die before you pay for the house. Renting means you can move to a larger or cheaper place as and when you like – or to a new area altogether. House maintenance should be taken care of by your landlord, and even some utility bills may be thrown into the price. If you fail to keep up your mortgage repayments, the banks will move pretty swiftly to boot you out, but many rental agencies or private landlords can often be paid much smaller sums in order to keep the roof over your head. Finally, if you are lucky enough to get help with your housing costs, many agencies will pay more to rented tenants than mortgaged individuals. Buying a house may still be seen as a good investment should the housing market go up in price – but at the moment it’s going down! – turning the whole thing into more of a gamble. Average lifetime saving (£): Variable.

With Gas and Electricity prices rising all the time, by far the easiest way to heat a home is to go back to the old ways – with a wood burring stove. Stoves can be bought relatively cheaply, and one will pay for itself in a couple of years. Fuel is never a problem (and often free) as long as you live near a wood yard, a coppice project, a paper mill, a saw mill, or even a dump (where wood is available by the skip load). A cheap circular saw can be bought for as little as £10, and means you can chop up tables, cabinets, dressers, and just about anything else. Sick and tired of all that junk mail? Bung it in, and make it heat your home! Endless stacks of paper products?, cereal boxes?, packaging? Recycle it the original way and save the planet. Supermarkets are also a good source of material – and are usually more than willing to see the back of banana boxes and all kinds of packaging. On top of all that, a good stove burner could be adapted into the water system of your home; so you can use it to take a bath. Stoves can also be cooked upon too!. Finally, they are great for giving a home that natural heat that helps you feel drowsy and have a good nights sleep. Average yearly saving (£): Over £140 ($210)

With the advent of the Internet, technology now allows a cheaper viewing experience. If you are lucky enough to live in an area where most of the material on TV is available online and on demand, there really is no reason to pay for TV anymore. In the UK, the cost of a TV license can be over £100 a year. With a good graphics card on your computer, you should be able to connect your TV to it; meaning ANY output from your machine can be directed to play on the big screen with the touch of a button. This also means that your television watching habits can be tailored to your own on-demand needs, and you won’t be paying for all those waste-of-time shows which clog many networks these days. Finally, with the advent of shared downloads, you can now have your favorite shows on your hard drive and play them direct – saving you buying or burning all those DVDs. Average yearly saving (£): Over £120 ($180).

Now this had to come up at some point, but this could make a HUGE difference to your expenditure over a year. By far the easiest way to budget is to type in all your outgoings and bills in monthly columns on a spreadsheet. Below these, enter whatever income you have – and then take the outgoings amount away from your combined income. Hay presto! Your disposable income pops up at the bottom. Budgeting a whole year in advance can show you what shape your bank account will be in during the months to come; helping you save more if things look tight, or to afford those little luxuries without fear of going into the red. A budget can also help you as you tinker with the figures – shaving money off here and there – allowing you to maximize whatever money you have available to you. Average yearly saving (£): Unlimited.

On several occasion I have house-shared as a means of cutting the house-hold bills in half. A paying guest can ‘lodge’ for any price you set – and many are happy to pay as much as you would pay to rent the house on your own. Similarly, many are willing to split the rent and the bills; resulting in a very much less expensive way to live. Of course, house sharing does have a few drawbacks; such as privacy;

but at the end of the day it’s up to you whether you want to keep them or to send them on their way. House mates can also be very good company, very good partners on a night out, may be great (free) babysitters, and may be a convenient way to car share. Average yearly saving from a house-share (£): £3800 ($5,800).

In some parts of the world, water bills are calculated on the average usage in your community, or at least on your block. That is fine if you use as much as everyone else; but not so good if you live on your own or prefer to smell nasty from not taking baths! For singles or students then, having a water meter installed could save you a small fortune as it means you will only pay for what you use. So, by not washing the car, or by doing the dishes in a bowl rather than in a dish-washer, or taking showers instead of baths – you can save on your usual water bill. For quite a few household jobs – such as watering the garden and washing the car – the water you need comes from the sky – for FREE – and is worth collecting if you have a water meter. Average yearly saving (£): Over £120 ($180).

Running a car can be a very expensive business, so fuel economy can be an easy way to save those extra penny’s. First of all, keeping your car in shape is by far the quickest way to start saving. For example: ensuring the tires are inflated to the correct PSI and have plenty of rubber, changing the air and oil filters, removing excess weight, and driving carefully; can mean your fuel can last at least 10-20 MPG longer. Race starts, revving the engine, and driving over 70MPH (112kph) uses up fuel quickly, and could only result in saving you minutes at the other end. The best speed for fuel economy is 56MPH (90kph). Buying a diesel or a car with good fuel economy (over 50mpg) is also a big consideration, and could cut the average fuel bill by half over a year. Car sharing is great as it means you are sharing the cost of driving between you, and if you alternate between each others cars it could mean you are traveling half as often in your own car. Small journeys eat into your fuel reserve more than long ones because of the time it takes the car to warm up. If you reach your destination before the ‘choke’ switches off you will have used an extra 10% of fuel in your journey. For this reason, it is better to shop around all in one day rather than popping into town every day for little bits. If you can, walk. Walking is free, and every trip saved is an extra trip you can make on the same tank of gas. Average yearly saving (£): Over £100 ($150).

Now this might sound obvious, but eating take-outs can be far more expensive than eating your own home cooked meals. Take-outs; although often very tasty; can contain materials which actively make you hungrier or thirstier – causing you to consume more as a result. Ordering out for food or going out for meals can really make a big difference to a shopping budget, and can turn one of life’s greatest luxuries into a taken-for-granted habit. Saving take-outs for special days (i.e. Saturdays) and special occasions can make the experience even more exciting, even more sumptuous, and a whole lot cheaper. Average yearly saving by eating less take-outs (£): Over £120 ($180).

If saving on food is a little beyond your comfort zone then this next classic will have you screaming. With the credit crunch propaganda infiltrating the airwaves of late, many are left wondering how they will afford the basic household bills. One way is simply to economize on life’s luxuries – and by far the most common (and most expensive) luxuries are those concerning cigarettes and alcohol. For example, if you were to smoke 20 cigarettes a day, your yearly expenditure may average around £1800 ($2,800). If you were to cut down from 20 cigarettes a day to 10, this would go down to £900 ($1,400, a saving of £900 a year – or x30 fuel bills!). 7 cigarettes a day, and the cost goes down to around £550 ($850) a year; quit smoking and you could save the full £1800 ($2,800). Alcohol is very similar in that a single night out may cost anywhere between £20 and £60; so by going out just once a week less often; you could save between £960 (1,470) and £2880 ($4,400) over a year. Average yearly saving after quitting drinking and smoking (£): Over £6,660.

There are many ways to cut the shopping budget down to size. For starters, choose your shops carefully. If it can be ordered and delivered cheaper online (i.e. hard goods, media), this could save up to 50% on retail prices. As far as food goes, one supermarkets’ prices may not be too unlike anothers’, but there can be huge saving to be made if you are willing to shop around for the basic items. Convenience stores often hike their prices thinking that consumers will shop there anyway and swallow the difference. Milk, for example, may be a third more expensive at your local shop or gas station than it may be at a superstore. Over the year, these expenses mount up. However, if the price of a cheaper loaf of bread would cost you more in gas money to drive over and pick one up, then this would be false economy in that it would cost more overall for the same result. Average yearly saving (£): Over £480 ($).

Finally, why not maximize your income by eating healthily! Contrary to what you may think, eating veggie is very VERY cheap, and a full weeks worth of food may cost from as little as £10 ($15) a head. By far the cheapest way to have the best quality vegetables for your pot would be to grow your own. For the price of a packet of seeds (or a few carrot tops and sprouting potatoes) you can grow and rotate your stocks to provide an endless free supply of basic foods. A good steamer unit, an oven, and a magimix (for soups) will also save hours of gas or electricity bills as neither of these use too much juice to run. Eating veggie doesn’t necessarily mean avoiding meat – that’s up to you – you don’t have to be a vegetarian to eat veggie! Meat, fish and chicken can be used as you like, along with eggs, cheese, sauces, pickles and spices. The point is to avoid shopping for pre-packaged foods; in whatever variety they come; and simply eat fresh. Aside from fresh being far less expensive (even totally free!), fresh also contains far less additives, comes with far less packaging, and is FAR more beneficial for the mind and body. Average yearly saving by growing your own veggies (£): £900 ($1,400) per head.

Summary: So there you have it. If you invest in a good budget and a wood burning stove to heat and cook on, get a suitable house mate, cut down or cut out the cigs, booze and the take-outs, get a water meter, don’t pay for TV, and grow and eat veggie – you could save a fortune. I did all the above, and although I didn’t sacrifice too much of my social life I still managed to save… £12,700 year-on-year ($19,500).