Movies and TV

Movies and TV  Movies and TV

Movies and TV  Creepy

Creepy 10 Eerie & Mysterious Ghosts of the Pacific Coast

Weird Stuff

Weird Stuff 10 Typos That Accidentally Changed History

History

History 10 Times Trickery Won Battles

Technology

Technology 10 Awesome Upgrades to Common Household Items

Misconceptions

Misconceptions 10 Hilarious (and Totally Wrong) Misconceptions About Childbirth

Weird Stuff

Weird Stuff 10 Warning Labels That Exist Because Someone Actually Tried It

Health

Health Ten Confounding New Inventions from the World of Biomedicine

Creepy

Creepy 10 Death Superstitions That Will Give You the Creeps

Movies and TV

Movies and TV 10 Movies That Get Elite Jobs Right, According to Experts

Movies and TV

Movies and TV 10 Most Realistic Medical TV Shows of All Time

Creepy

Creepy 10 Eerie & Mysterious Ghosts of the Pacific Coast

Weird Stuff

Weird Stuff 10 Typos That Accidentally Changed History

Who's Behind Listverse?

Jamie Frater

Head Editor

Jamie founded Listverse due to an insatiable desire to share fascinating, obscure, and bizarre facts. He has been a guest speaker on numerous national radio and television stations and is a five time published author.

More About Us History

History 10 Times Trickery Won Battles

Technology

Technology 10 Awesome Upgrades to Common Household Items

Misconceptions

Misconceptions 10 Hilarious (and Totally Wrong) Misconceptions About Childbirth

Weird Stuff

Weird Stuff 10 Warning Labels That Exist Because Someone Actually Tried It

Health

Health Ten Confounding New Inventions from the World of Biomedicine

Creepy

Creepy 10 Death Superstitions That Will Give You the Creeps

Movies and TV

Movies and TV 10 Movies That Get Elite Jobs Right, According to Experts

10 Ways Car Dealers Make Money Off You

At some point in our lives, we all have to buy a car. Whether it be brand new or second hand, we usually end up going through a dealer. This list is designed to help you save money by not being ripped off by the little tricks that dealers use to maximize their profit and your loss. Be sure to give other tips for saving on a new car in the comments.

This is the most obvious of ways a car dealer makes a profit. The difference between the dealer cost (invoice) and MSRP is typically 5-10%. This may not sound like a ton of mark-up, but when you consider that you’re dealing with thousands of dollars then the profit margin could be quite significant. For example, a car that a dealer pays $30,000 could generate a profit of around three-thousand dollars. And then multiple that times a few hundred cars a month, and a car dealer could make almost a million dollars a month on mark-up alone.

When a dealer sells a new car (not a pre-owned), the sale is RDR’d to the manufacturer (basically informing the manufacturer that one of their units has been sold). Once this sale has been verified, the manufacturer pays the dealer a set amount of money for “hold-back” and advertising. This amount is listed on the invoice in a less-than-obvious location and is often abbreviated/written in a way that a customer will be unable to figure out the information in the event he sees the actual invoice. For example: if an educated customer will only pay a certain percentage over invoice, then that percentage is calculated by the “invoice” price before any “hold-back” or advertising is deducted. Once the deal is funded and the contract is RDR’d, the manufacturer will send the dealer a pretty substantial amount of money (I’ve seen some “hold-back” and advertising fees as much as $1500).

When a person trades in a car, the dealer will surely attempt to undervalue the trade to make an immediate profit, and then a profit later when the trade is sold. The immediate profit comes from what is called the ACV (actual cash value). If a trade is really worth $11,500 (ACV) and the dealer only shows the customer $10, 500, then there is an immediate thousand dollar profit from the start. The trick is to know where a dealer gets his appraisal information (the most common are Black Book and Manheim Auction Reports. Dealers will RARELY match Kelly Blue Book and NADA) and work off that number to get a fair value for your trade. The other means the dealer will make a profit is when he sells your trade in. There are many financial and credit factors that can generate a profit from your trade. Simple example: your trade is bought from the dealer for $10,000. The dealer will then send your car through service and detail and make sure it is prepped for retail and safe to drive (he’ll also insure the car in most instances). Your old car will now be put up for sale for $13,999. Now, here’s where many factors come is based on the potential buyers situation. The lenders will “book out” a car based on a standard process (typically, a program called Dealer-Track will provide access to NADA for the banks and the dealerships to see how much a car can be sold for). Banks will loan a certain percentage of the cars loan value based on the customer’s credit worthiness. Let’s say the car “books out” for $13,125 (this is 100%), and the potential buyer has great credit. The lender will loan up to 135% of the cars value for that customer. Which means the dealer can sell the car to that well-qualified customer for over $17,000 and make a nice profit ($7,000). On the other hand, if a person has poor credit, then the banks will loan less than 100% and the dealer will have to take the deal at a lesser profit, or the customer will have to put some cash down to generate a profit the dealer will agree to.

New and Used cars are “packed.” This is a number that is immediately added to the car (in addition to the already existing mark-up). This is typically money that goes to pay the owner. The amount of pack varies between dealerships, new, used, etc, but I have never seen a “pack” less than $500. I’ve even seen some cars “packed” $1500. Let’s say a dealership sell 250 cars in one month, and the average “pack” is $1000: the owner makes a nice quarter million dollars a month on “pack” alone (3 million a year- not a bad salary).

This is the biggest farce of them all. This is a dollar amount the dealer says goes to pay for the process of handling your paperwork, tag work, title work, tax work, loaner car, etc. The doc fees will fluctuate from dealer to dealer (I’ve seen $299 to $699). This is a legitimate process that does require paying a handful of people for their work, but- in no way does it cost anywhere close to the amount they’re charging. Most of the paperwork can be done is a few minutes and over the phone, internet, fax, etc. The overage naturally goes into management’s pockets.

Bad bad business practice right here. A “bump sticker” is legitimate-looking sticker that the dealer places next to the manufacturer’s window sticker with a higher priced MSRP than the actual MSRP. The dealer will try and justify this added cost by suggesting the car had some special product applied to the paint or the fabric, or some window etching was done, or they’ll try and itemize all the work that needed to be done to get the car prepped for retail (insurance, gas, detail, service, PDI- [post delivery inspection], etc), or they might try and tell you that this car had additional mark up because it’s a “hot item” and people are paying over retail for that car. It’s all a joke and educationally insulting. The theory is once the “bump sticker” is negotiated away, then the customer will feel that he got a pretty substantial discount, when- in fact- he’s simply paid full MSRP for the car: not a very good deal.

When a customer agrees to numbers, they will have to go the F and I office (Finance and Insurance) to finalize the car deal. This is where all the legal forms are signed, etc. However, this is also where a lot of money is made for the dealership. One of the big money makers in the car business comes from the sale of Extended Service Contracts (extended warranty). I would say nine out of ten extended warranties will cover things that are never likely to break. Additionally, you’ll need to pay a deductible (on top of the $1400 dollars you just paid for the warranty) each time you try and use the warranty. The mark up for this product is typically mandated by the state you live in, but you can expect to pay twice its original value. One good thing about an extended service agreement is that most of them are refundable (prorated based on what you haven’t used). Additionally, a certified pre-owned model is typically a better bet than an extended service agreement (because it’s backed by the manufacturer’s name. Extended warranties are typically backed by the private dealer with a lot less public reputation at stake).

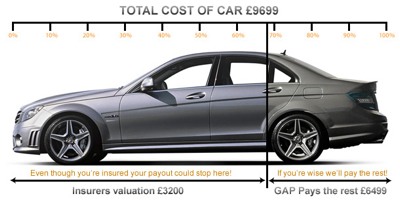

Now this is a product that I strongly recommend you buy: it could turn out to worth its weight in gold. However, you don’t have to pay $599 for it at the dealership when you can get it at your local credit union for $150. Basically, GAP insurance satisfies the car loan in the event of theft or total loss. Your insurance company will only pay ACV for your loss, but GAP insurance picks up the “negative equity” you have remaining on your loan. For example: My car is worth $11,000, but I owe $16,000. In the event of a total loss of my car, the insurance company will only pay my lender $11,000 towards the loan leaving me having to come out of my pocket $5000 to satisfy the loan. However, GAP insurance pays the difference and I’m off Scott free to go buy a new car free and clear of any additional payment on the lost car.

A person with good credit should never have to put a down payment towards the purchase of a new car. However, there are some instances where it may be a necessary (too much negative equity in trade, personal need to lower monthly note, etc). But typically, if a customer is satisfied with their payment, and they don’t have a significant amount of negative equity, then the bank should have no problem lending money to a well qualified buyer. Sometimes a salesman or sales manager will say ‘The lender is requiring 20% down,” or they might say “You’re going to have to pay your taxes in cash. The bank will finance the car, but they will not finance any taxes or fees.” This is a lie. If you can secure your own financing (personal bank, credit union, etc) before you buy, then that would be in your best interest and eliminate a lot of the shenanigans that can happen at the dealership. Additionally, when the sales managers offer is itemized with a down payment and payment listed, the payment- more times than not- can be retained without the requested money down. Down payments usually result in sheer profit for the dealership.

This little gem is another reason car dealers get a bad rap. When a sales manager submits your application to lenders for approval, the lenders will reply with what’s called a “call back.” The “call back” details the requirements for the loan. Example: let’s say the sales manager submits the numbers to a prime lender- we’ll use BB & T- for approval. BB & T will reply with terms (24/36/48/60/72 months), maximum amount financed, stip’s (proof of income, proof or residency, references, etc), and what’s called a “buy rate.” The “buy rate” is the interest rate the lender has approved for the loan- let’s use 7.9%. Well, here’s where the finance manager can steal from you. Typically, the lender will allow the dealership to make 2 points of rate if you’re still ok with the payment. That means the rate you’ve earned is 7.9%, but the dealer can contract you at 9.9% and the bank will pay the dealer the overage from the rate. This puts LOTS of cash in their pockets. Next time you buy a car and finance with one of the dealerships banks ask the finance manager to see the call back from the bank and compare that rate with the interest rate he’s trying to sign you up for. If he refuses, then he’s holding points of rate and he doesn’t want you to see that he’s trying to get you to pay a higher rate.

Contributor: Kay Jay