Animals

Animals  Animals

Animals  Facts

Facts Ten Unexpectedly Fascinating Facts About Rain

Crime

Crime 10 Dark Details of Australia’s Gruesome Unsolved Wanda Murders

Humans

Humans 10 Unsung Figures Behind Some of History’s Most Famous Journeys

Animals

Animals 10 Species That Refused to Go Extinct

Weird Stuff

Weird Stuff 10 Weird Things People Used to Do at New Year’s

Our World

Our World 10 Archaeological Discoveries of 2025 That Refined History

Weird Stuff

Weird Stuff 10 Fascinating Facts You Might Not Know About Snow

Miscellaneous

Miscellaneous Top 10 Things Crypto Was Supposed to Change & What Actually Did

History

History 10 Huge Historical Events That Happened on Christmas Eve

Animals

Animals 10 Strange Times When Species Evolved Backward

Facts

Facts Ten Unexpectedly Fascinating Facts About Rain

Crime

Crime 10 Dark Details of Australia’s Gruesome Unsolved Wanda Murders

Who's Behind Listverse?

Jamie Frater

Head Editor

Jamie founded Listverse due to an insatiable desire to share fascinating, obscure, and bizarre facts. He has been a guest speaker on numerous national radio and television stations and is a five time published author.

More About Us Humans

Humans 10 Unsung Figures Behind Some of History’s Most Famous Journeys

Animals

Animals 10 Species That Refused to Go Extinct

Weird Stuff

Weird Stuff 10 Weird Things People Used to Do at New Year’s

Our World

Our World 10 Archaeological Discoveries of 2025 That Refined History

Weird Stuff

Weird Stuff 10 Fascinating Facts You Might Not Know About Snow

Miscellaneous

Miscellaneous Top 10 Things Crypto Was Supposed to Change & What Actually Did

History

History 10 Huge Historical Events That Happened on Christmas Eve

Top 10 Truly Bizarre Taxes

Tax is the bane of all of our lives. Indeed, as the old saying goes, “nothing is certain but death and taxes”. Governments (and not just democratic ones) seem to find the most inane things to tax; they especially like popular activities and goods, as is evidenced by the recent attempts of various governments to tax the Internet. If there is a way for them to make sure you are using it, they will tax it. In the United Kingdom televisions are taxed via the television license – though, fortunately, if you are legally blind you only have to pay half of it.

This list looks at ten of the most ridiculous taxes to have been levied in both the past, present and future. If you know of others that you think fit the bill for this list, be sure to share them with us all in the comments.

The card tax is a great example of people being taxed for something which is popular and pleasurable. At the time of the instutution of the tax, playing cards was extremely popular after dinner (no doubt due to the lack of televisions and playstations) so the King saw an opportunity to fleece his people. The tax, along with the fancy design and manufacturer’s logo commonly displayed on the Ace of Spades began under the reign of James I of England (16th-17th century), who passed a law requiring an insignia on that card as proof of payment of a tax on local manufacture of cards. Until August 4, 1960, decks of playing cards printed and sold in the United Kingdom were liable for taxable duty, and the Ace of Spades carried an indication of the name of the printer and the fact that taxation had been paid on the cards.

In September 2009, the state of Illinois decided to tax candy at a higher rate than other food. The Illinois Department of Revenue carefully explains that “if an item contains flour or requires refrigeration,” it is not considered candy and is taxed at the same lower rate as other food. This explanation legally classifies yogurt covered raisins as candy, but yogurt covered pretzels as food; Baby Ruth bars as candy, but Twix bars as food; Milky Way Midnight bars as candy, but original Milky Way bars as food. [Source]

In the United States, the jock tax is the colloquially named income tax levied against visitors to a city or state, who earn money in that jurisdiction. Since a state cannot afford to track the many individuals who do business on an itinerant basis, the ones targeted are usually very wealthy and high profile, namely professional athletes. Not only are the working schedules of famous sports players public, so are their salaries. The state can compute and collect the amount with very little investment of time and effort. And as we all well know, the government doesn’t like to put an effort into anything.

The cowardice tax (properly known as scutage) was a special tax levied against people who chose not to fight for the King (not just for reasons of cowardice). The institution existed under Henry I (reigned 1100–1135) and was initially relatively cheap, but then King John raised it by 300% and started charging it to all knights in years in which there were no wars. This is partly what led to the Magna Carta. The tax lasted for around 300 years and was eventually replaced by other methods of fund-raising from the military.

The hat tax was a tax levied by the British Government from 1784 to 1811 on men’s hats. The tax was introduced during the first ministry of Pitt the Younger, and was designed to be a simple way of raising revenue for the government in a rough accordance with each person’s relative wealth. It was supposed that the rich would have a large number of expensive hats, whereas the poor might have one cheap hat, or none at all. The hat tax required hat retailers to buy a license, and to display the sign Dealer in Hats by Retail. The cost of the retail license was two pounds for London and five shillings elsewhere. Heavy fines were given to anyone, milliner or hat wearer, who failed to pay the hat tax. However, the death penalty was reserved for forgers of hat-tax revenue stamps.

The window tax was a significant social, cultural and architectural force in the kingdoms of England, Scotland and, then, Great Britain during the 17th and 18th centuries. Some houses from the period can be seen to have bricked-up window-spaces (ready to be glazed at a later date), as a result of the tax. The tax was introduced under the Act of Making Good the Deficiency of the Clipped Money, in 1696, under King William III, and was designed to impose tax relative to the prosperity of the taxpayer, but without the controversy that then surrounded the idea of income tax. When the window tax was introduced, it consisted of two parts: a flat-rate house tax of 2 shillings per house and a variable tax for the number of windows above ten windows. The richest families in the kingdoms used this tax to set themselves apart from the merely rich. They would commission a country home or a manor house whose architecture would make the maximum possible use of windows. In extreme cases they would have windows built over structural walls. It was an exercise in ostentation, spurred by the window tax. Amazingly, the tax was not repealed until 1851.

In 1535, King Henry VIII of England, who wore a beard himself, introduced a tax on beards. The tax was a graduated tax, varying with the wearer’s social position. His daughter, Elizabeth I of England, reintroduced the beard tax, taxing every beard of more than two-weeks growth. The tax also appeared in Russia but for a different reason: to make the people shave as the Tsar considered beards to be uncultured. In 1705, Tsar Peter I of Russia instituted a beard tax. Those who paid the tax were required to carry a “beard token”. This was a copper or silver token with a Russian Eagle on one side and on the other, the lower part of a face with nose, mouth, whiskers, and beard. It was inscribed with two phrases: “the beard tax has been taken” and “the beard is a superfluous burden”.

The “crack tax” is a name given to the taxes on illegal drugs in Tennessee. The tax, under a law passed by the Tennessee General Assembly, in January, 2005, is applied to illegal substances, including cocaine, marijuana and moonshine. Drug dealers are required to pay anonymously at the state revenue office, where they receive a stamp to prove their payment. If a drug dealer is arrested without having a stamp, the state would seek the money owed it. 22 other states have drug collection laws similar to the crack tax in Tennessee; the law was based upon that of North Carolina’s. Another often taxed illegal activity is prostitution.

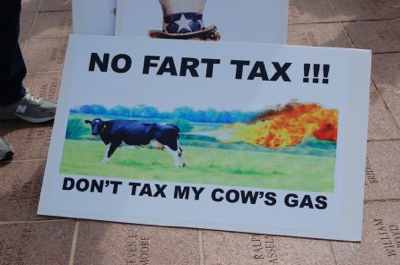

The Agricultural emissions research levy (commonly described as a “flatulence tax” or “fart tax”) was a tax proposed in New Zealand, in 2003, to assist with compliance with the Kyoto Protocol. The tax would target the release of methane by farm animals, which, in New Zealand, account for over 50% of the greenhouse gas emissions. Needless to say there was an outcry due to the importance of farming in New Zealand and the Labour government eventually gave up their ridiculous idea to tax cow’s farts.

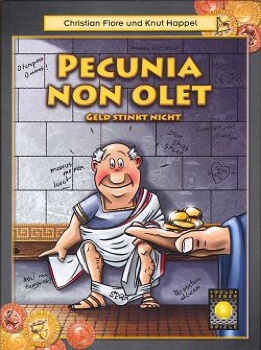

Pecunia non olet (money does not stink). This phrase was coined as a result of the urine tax, levied by the Roman emperors Nero and Vespasian in the 1st century, upon the collection of urine. The lower classes of Roman society urinated into pots which were emptied into cesspools. The liquid was then collected from public latrines, where it served as the valuable raw material for a number of chemical processes: it was used in tanning, and also by launderers as a source of ammonia to clean and whiten woolen togas. There are even isolated reports of it being used as a teeth whitener (supposedly originating in what is now Spain). When Vespasian’s son, Titus, complained about the disgusting nature of the tax, his father showed him a gold coin and uttered the famous quote. This phrase is still used today to show that the value of money is not tainted by its origins. Vespasian’s name still attaches to public urinals in France (vespasiennes), Italy (vespasiani), and Romania (vespasiene). [Source]

Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. Text is derived from Wikipedia.