Our World

Our World  Our World

Our World  Pop Culture

Pop Culture 10 Incredible Female Comic Book Artists

Crime

Crime 10 Terrifying Serial Killers from Centuries Ago

Technology

Technology 10 Hilariously Over-Engineered Solutions to Simple Problems

Miscellaneous

Miscellaneous 10 Ironic News Stories Straight out of an Alanis Morissette Song

Politics

Politics 10 Lesser-Known Far-Right Groups of the 21st Century

History

History Ten Revealing Facts about Daily Domestic Life in the Old West

Weird Stuff

Weird Stuff 10 Everyday Products Surprisingly Made by Inmates

Movies and TV

Movies and TV 10 Actors Dragged out of Retirement for One Key Role

Creepy

Creepy 10 Lesser-Known Shapeshifter Legends from Around the World

Our World

Our World 10 Science Facts That Will Change How You Look at the World

Pop Culture

Pop Culture 10 Incredible Female Comic Book Artists

Crime

Crime 10 Terrifying Serial Killers from Centuries Ago

Who's Behind Listverse?

Jamie Frater

Head Editor

Jamie founded Listverse due to an insatiable desire to share fascinating, obscure, and bizarre facts. He has been a guest speaker on numerous national radio and television stations and is a five time published author.

More About Us Technology

Technology 10 Hilariously Over-Engineered Solutions to Simple Problems

Miscellaneous

Miscellaneous 10 Ironic News Stories Straight out of an Alanis Morissette Song

Politics

Politics 10 Lesser-Known Far-Right Groups of the 21st Century

History

History Ten Revealing Facts about Daily Domestic Life in the Old West

Weird Stuff

Weird Stuff 10 Everyday Products Surprisingly Made by Inmates

Movies and TV

Movies and TV 10 Actors Dragged out of Retirement for One Key Role

Creepy

Creepy 10 Lesser-Known Shapeshifter Legends from Around the World

Top 10 Reasons Why Capitalism Sucks

Now that it’s Christmas season again, it seems like a good opportunity to respond to the list 10 Greatest Benefits of Capitalism with which I believe there were a number of problems. Firstly, it was not clear which form of capitalism was being described, so I would like to begin this list by defining the free market, which is capitalism in its most simple form. I’ll highlight the many issues which arise with a pure free market, and which are undermining capitalism as we speak.

A free-market economy is one where all markets are unregulated by the government. There is no economic intervention or regulation by the state, with the exception of enforcing private contracts and the ownership of property. The USA, with its minimal business regulation, is one of the countries that is closest to free-market capitalism today. But capitalism applies to over 80% of countries in the world, and nearly everybody worldwide is involved in the market. So the following problems apply to YOU!

Thousands of Trans-National Corporations (TNCs) exist, and many have the financial size of a small country. The common business strategy is to produce goods in developing countries where wages are cheap, then transport and sell them in rich countries like the USA where prices are high. Essentially, this is buy-low, sell-high on a major scale: a sure recipe for success.

But there is a problem with this strategy. The TNC employs in whichever country is cheapest, after the costs of land, labour and rights are combined (note that rights – such as the worker’s right to a reasonable wage by western standards – are a cost to the TNC). This means that countries wanting TNC investment are in competition to lower wages, lengthen working hours and reduce workers’ rights. The resulting ‘race to the bottom’ is a blight on human rights worldwide.

Recently there has also been a worrying polarization of wealth around the world. Last year the top-earning 20 percent of Americans received 49.4 percent of all income generated in the USA, compared with just 3.4 percent made by the bottom 20 percent of earners. This ratio of 15:1 is approximately double that of 8:1 in 1968. Unfortunately, the free market encourages this wealth divide – there is every incentive for people to earn more; charities only survive out of people’s extreme kindness and dedication.

Given the current state of affairs, there is no reason why the rich-poor divide will not increase even more, with those at the top of corporations exploiting unfortunates in poor countries. Karl Marx said this divide would be the inevitable cause of communism, but at the moment it is causing only greed, misery and well-intentioned social programs that are heavily abused.

In a free market, there are the costs of ‘wheeling and dealing’: advertising, insurance and marketing are professions that make up around 6% of employment in the USA. The labor power here is effectively going to waste, since it does not create anything or directly make anyone better off. Advertising is obviously essential for businesses to sell their product, but the money spent on it could be much better used elsewhere if only sales were guaranteed by other means. This is what happened in the planned economy of the USSR, where producers could concentrate all of their resources on production and leave the marketing and distribution to the government, whereas nowadays marketing is in many respects more important than production – is this how business should be?

Some goods and services are considered positive for society. You might get a vaccine against swine flu to protect yourself against getting the illness, and in doing so reduce the spread of the virus. This has a positive side-effect on the rest of society, but it is unlikely that you considered this when making the decision – you only thought about protecting yourself.

Because everyone thinks about only their own personal benefit the vaccine is underconsumed as a whole – less good things are bought than society ultimately wants. One way of solving this is through subsidies (as with public transport in London), which make commodities cheaper and therefore more popular, or else by making the vaccine obligatory (as is done with education). Both of these methods require government action.

A multitude of goods and services require everyone’s contribution to exist. Take street lighting, for example, and imagine that this essential service were to be provided by a business on the free market for a fee. One night you pay to turn the lights on for a journey, but the problem is that as soon as you do so, your neighbor runs out to use the well-lit streets for free.

This is called the ‘free rider problem’ and it means that such goods and services, known as ‘public goods’, can only be provided by the state since otherwise no individual would bother to pay for them. Other examples include roads, lighthouses and public fireworks. It is generally accepted that the free market is simply incapable of providing public goods.

Why does the latest version of Microsoft Windows cost so much when it’s just a piece of software? The answer is scarcity. For many years Microsoft held a near-perfect monopoly over the home programming market. This means that Microsoft was the only supplier of a useable operating system, and those who wanted a working computer had to buy Microsoft’s product, or else settle for a largely incompatible, unheard-of equivalent.

Microsoft could therefore charge whatever they liked, and their sales would still be high. More recently this has been mitigated by government regulation on monopolies (Microsoft were charged in 2002) and the advent of open source software such as Linux, which was designed as a direct response to this situation, although Windows is so widely used that Microsoft still controls the major industry conventions and so is likely to be recording huge profits for years to come.

Microsoft is an obvious example, but you might be wondering to what other industries this theory applies. The truth is that ‘scarcity power’ affects almost everything: scarcity of their brand allows Coca-Cola to overprice; scarcity of private employers allows the government to underpay teachers; scarcity of location allows shops in tourist areas to overcharge their customers. Governments worldwide try to limit these problems by preventing mergers and cartels (several ‘competing’ businesses collaborating to fix prices), but the latter is difficult to prove and there is often little that can be done anyway.

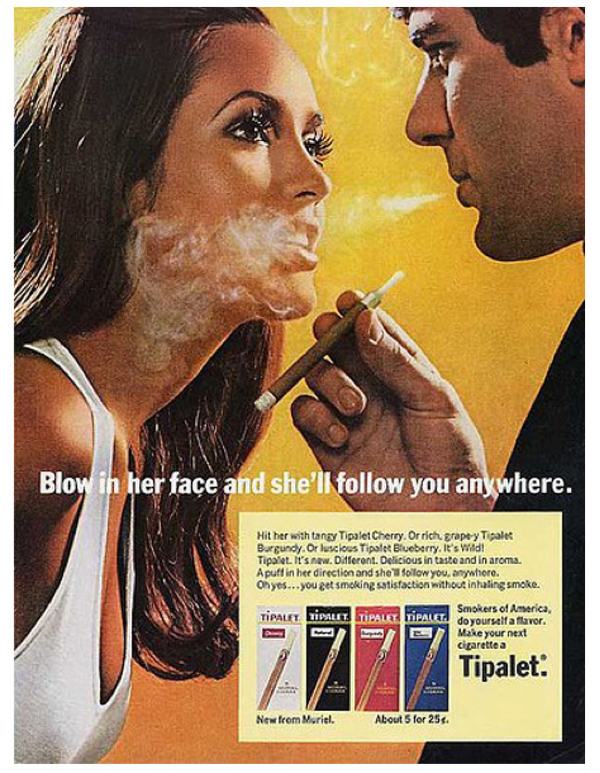

I walk into a newsagents to buy a packet of cigarettes. The cost to me is the price of the packet and the damage to my health, while my personal benefit is the enjoyment of the drug. I decide it is worth the expense and make the purchase.

But what about you and other passers-by who have to walk through my fumes? Had I considered this when buying the cigarettes I would have realized that the social costs of the sale were greater than my personal costs, and should have been factored into in my decision. This is the crux of the matter: in an ideal society, many fewer cigarettes would be sold than actually are, because of the recognized adverse effects on other people. These occur to neither the buyer nor the seller – they are external to the immediate parties in the market and are known as ‘externalities’.

Other negative externalities that are not reflected by the prices in a free market system include air pollution, noise and congestion caused by cars; damage caused by drunk people; and eyesores caused by such things as power stations. Only through government intervention can such externalities be ‘internalized’ (brought within the market system, for example by taxing the transaction to make the buyer pay for the social cost) and the market failure corrected.

Let us start from scratch with the health industry. An insurance company allows you to pay $1000 per year to cover all your doctors’ appointments, emergency provisions, and so on. Some people who are sickly and accident-prone consider this a bargain and pay for the insurance. Others, like you, might be healthy and in the prime of life – so you decide this price is not worth it.

The result is that the only people who buy insurance are the sickly people likely to make many claims, and the company must raise their prices to cover itself against all these accidents. But with this higher premium, people with middling health are less likely to pay, forcing the insurance company to raise prices yet again. This process will theoretically force everyone out of the market. In reality this does not quite happen because people are careful about their health and therefore willing to pay a little more than maybe they ‘should’, but the result is still a patchy system with poor coverage.

The insurers can try to gauge people’s risk by asking about smoking, exercise, age etc but the advantage is still with the customer. This inside knowledge creates a system of ‘asymmetric information’, meaning that the customers are more informed than the business and this threatens to destroy the industry altogether.

In addition to the above, there are the huge costs to business of keeping up with the competition. An example might be the innovation that is constantly occurring in Formula One: every team has a crack group of scientists working hard to make their cars fractionally faster than the opposition, because each team keeps its latest advances a secret from the others.

Theoretically, it would be much cheaper and more efficient – for every team – if there were just one or two groups of scientists who shared information on car design to everyone. This would not work, however, because at least one team would doubtlessly spend on private development in order to gain an advantage over the others. Eventually we end up with a large department for every team – the current situation. This is but one incarnation of the ‘Tragedy of the Commons’, where common resources are wasted due to private greed.

In a controlled economy, the government decides which commodities will be produced, by whom, and where they will go. The unplanned free market capitalist economy, however, relies on individuals buying products – and for this to happen, the consumer has to want them. For this reason, corporations spend billions on extensive advertising campaigns, trying every trick in the book (and more) to convince you and I that we need their product.

I like using my cell phone to send texts and receive calls, but I realized today that I need a camera and internet access because it will vastly improve my life! And this very morning my wife was content, but after seeing dozens of airbrushed size 0 women on billboards just on the way to the corner shop, she apparently has to buy an outrageously priced beauty product.

The truth is that, by its very nature, capitalism breeds discontent. If we were happy – the system would fail!