History

History  History

History  Food

Food 10 Weird Foods Inspired by Your Favorite Movies

Religion

Religion 10 Mind-Blowing Claims and Messages Hidden in the Bible Code

Facts

Facts 10 Things You Never Knew about the History of Gambling

Weird Stuff

Weird Stuff 10 Cool and Creepy Facts about Collecting Tears

Humans

Humans The Ten Most Lethal Gunslingers of the Old West

Misconceptions

Misconceptions 10 Phony Myths and Urban Legends That Just Won’t Die

History

History 10 Amazing Roman Epitaphs

Weird Stuff

Weird Stuff 10 Niche Subcultures That Are More Popular Than You Might Think

Mysteries

Mysteries 10 Tragic Disappearances and Deaths in Joshua Tree National Park

History

History Top 10 Tragic Facts about England’s 9 Days Queen

Food

Food 10 Weird Foods Inspired by Your Favorite Movies

Religion

Religion 10 Mind-Blowing Claims and Messages Hidden in the Bible Code

Who's Behind Listverse?

Jamie Frater

Head Editor

Jamie founded Listverse due to an insatiable desire to share fascinating, obscure, and bizarre facts. He has been a guest speaker on numerous national radio and television stations and is a five time published author.

More About Us Facts

Facts 10 Things You Never Knew about the History of Gambling

Weird Stuff

Weird Stuff 10 Cool and Creepy Facts about Collecting Tears

Humans

Humans The Ten Most Lethal Gunslingers of the Old West

Misconceptions

Misconceptions 10 Phony Myths and Urban Legends That Just Won’t Die

History

History 10 Amazing Roman Epitaphs

Weird Stuff

Weird Stuff 10 Niche Subcultures That Are More Popular Than You Might Think

Mysteries

Mysteries 10 Tragic Disappearances and Deaths in Joshua Tree National Park

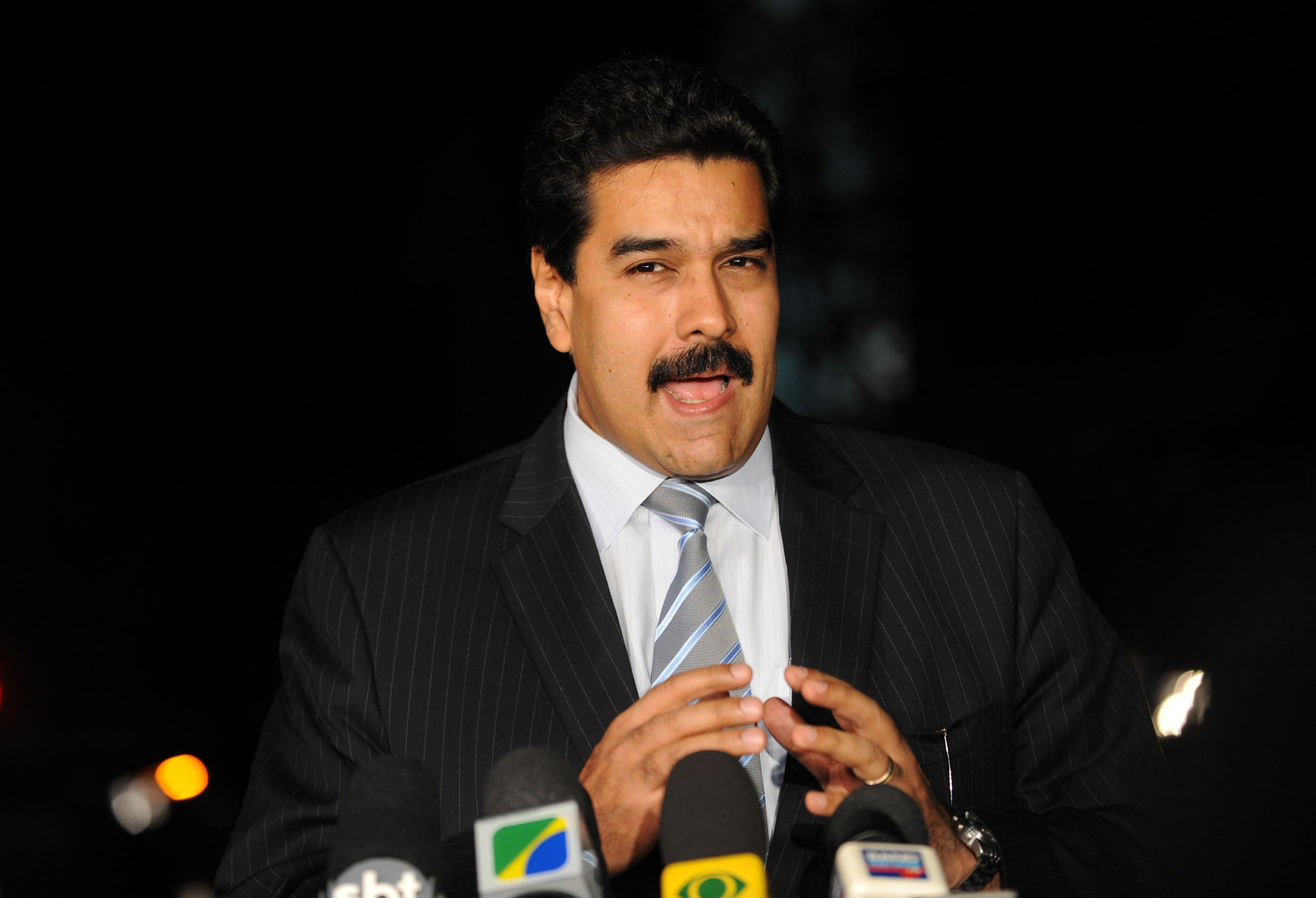

10 Reasons The Future Is Dark For Venezuela

Nicolas Maduro, president of Venezuela since 2013, is playing a tense political game while his country heads toward an almost certain default on its debt. On Wall Street, swaps traders recently put the odds that Venezuela would default within five years at 97 percent—and they estimated a 75 percent chance that the default would actually come within the next year. In other words, it’s probably not a question of if Venezuela will default, but when and how.

Recently, Maduro went on an international tour to beg for money from Middle Eastern and Asian countries and for oil price support from OPEC. As of this writing, he’s received a new $20 billion commitment from China for investments in Venezuela, although it’s unclear if the deal includes any free cash to reduce the risk of default this year. Qatar is also studying the possibility of investment. But this is unlikely to be enough to save Venezuela, especially in the long term.

10It’s Deja Vu All Over Again

When Maduro returned from his international fundraising tour in January 2015, he attempted to deflect blame for the situation, claiming once again that the US and other enemies of his leftist government were responsible for Venezuela’s dire economic straits.

But the truth is that Maduro and his predecessor, Hugo Chavez, must take responsibility for Venezuela’s current financial problems, which were entirely predictable. In fact, this exact scenario has played out so many times in Latin America that two economists, Rudiger Dornbusch and Sebastian Edwards, edited a book about it in 1992.

In The Macroeconomics of Populism in Latin America, Dornbusch and Edwards explain: “Again and again, Latin America has seen the populist scenario played to an unfortunate end. Upon gaining power, populist governments attempt to revive the economy through massive spending [Phase I]. After an initial recovery, inflation reemerges and the government responds with wage and price controls [Phase II]. Shortages, overvaluation, burgeoning deficits, and capital flight soon precipitate economic crisis [Phase III], with a subsequent collapse of the populist regime [Phase IV].”

Venezuela is in Phase III and if Maduro doesn’t want to see his government fall in Phase IV, he needs to change his policies fast.

9It Started With Hugo Chavez

After years of windfall oil profits, OPEC member Venezuela should have been able to save more than enough money to pay its bills, even if the price of oil dropped. But Hugo Chavez, Venezuelan President from 1999 until his death in 2013, spent the money buying popular support with subsidies for gas and food, cash handouts, and other social programs. Chavez also provided his Caribbean neighbors with cheap financing to buy oil through a program called PetroCaribe. These programs genuinely did lift many people out of poverty, but to finance them, Chavez increased public foreign debt to $88.7 billion by the beginning of 2012, more than triple what it was when he became president. By the end of 2012, inflation had soared to 27.6 percent, the second-highest inflation rate in the world that year.

Chavez tried to fight inflation by nationalizing some businesses and imposing price controls on basic products. Unfortunately, nationalization scared away investors—companies such as Exxon Mobil and ConocoPhillips abandoned the country’s oil fields—and price controls made it unprofitable for local agriculture and industry to supply some products. So shortages and long lines became a way of life for many Venezuelans.

While demand for products soared, production in Venezuela dropped because of government policies. According to Dornbusch and Edwards, this is classic Phase II going into Phase III of populism’s economic ruin.

8Maduro Has Continued Chavez’s Policies

Although he has continued his predecessor’s economic policies and confrontational rhetoric, former bus driver Maduro simply doesn’t have the charisma of Chavez, who could enthrall a crowd like a televangelist. Chavez always played to the poor, just as Maduro does today. But Maduro doesn’t inspire the loyalty that Chavez did. Many of the poor stay with Maduro simply because they’re waiting for more giveaways, which they fear a different government will stop.

Ruth Padilla became a member of a pro-government group to get free social housing. She’s been waiting for a year. “Going to these marches is my only chance of getting a house. We have to keep supporting Maduro, not the opposition that just wants power.”

But the giveaways can’t continue indefinitely. Venezuela simply doesn’t have the cash. With his popularity plummeting to 22.6 percent, Maduro knows that the poor will abandon him when the subsidized food and free housing go away. There have already been large protests against his government.

Maduro is acting as though the falling price of oil is the problem, but in reality it has merely exposed underlying issues. As Margarita Lopez Maya, a historian at the Central University of Venezuela, correctly predicted in 2012: “In the long term, we’re headed for a situation of poverty. If oil income starts to run out, if the prices fall too much, there’s no productive engine here that can feed us. But while the price of oil is so high, fantasies can be paid for.”

Currently, inflation is soaring, crime is increasing, the cash crunch and product shortages have become critical. It’s a classic example of Phase III of economic ruin by a populist government. Phase IV, a new government, may eventually solve some of the country’s problems. But as we’ll see, it won’t necessarily stop a debt default.

7Maduro Needs To Drastically Cut Costs

Maduro needs to cut the country’s costly gas subsidies now. Depending on the exchange rate, it’s been estimated that Venezuelans can buy subsidized gasoline for as little as 18 cents a gallon, the cheapest in the world. The subsidy costs the government around $12–15 billion per year. The government spends another $7 billion per year on PetroCaribe, the program that provides cheap oil to Venezuela’s Caribbean neighbors. Thanks in part to these subsidies, Deutsche Bank estimates that the price of oil needs to be at least $120 per barrel for Venezuela to fund its spending. As of this writing, crude oil is around $45 per barrel.

Until recently, Maduro has been unwilling to slash either program. But in his State of the Nation address in January 2015, Maduro signaled that he was ready to raise gas prices this year, although he didn’t give details.

But if Maduro ends subsidies to the poor, his political base, they’ll probably turn against him. “Historically, the moments of social explosions in Venezuela are precipitated by specific measures,” said Alejandro Velasco of New York University. “Maduro knows this, which is why he has not taken the steps he needs to fix the economy.”

6Venezuela’s Complicated Foreign Exchange Policy

A foreign exchange rate is the rate at which one country’s currency can be converted into another country’s currency. In Venezuela, the official exchange rate for essential goods like food is “fixed” at 6.3 bolivares for one US dollar.

If the fixed rate becomes too different from the market (or “floating”) rate, a black market may develop for the currency. Inflation can also be a problem, which is what Venezuela is currently experiencing.

But Venezuela also has one of the craziest foreign exchange policies ever developed. Most countries have one official exchange rate, whether fixed or floating. Venezuela has three, all of which are fixed. As of late December 2014, the official rate was 6.3 bolivares per dollar for essential items like food and medicine. But there were also two other official rates of 11 and 50 bolivares per dollar for other goods. On the black market, the unofficial floating exchange rate was around 200 bolivares per dollar.

This three-tier system allows Maduro to control prices on goods—he’s used a preferred exchange rate to make items like Barbie dolls a holiday bargain. But as oil prices fall and Venezuela’s supply of dollars shrinks, this crazy system propels inflation and causes shortages of imported goods. International investors believe these controls drain Venezuela’s foreign currency reserves, which are used to pay down debt, thus making a default more likely.

In January 2015, Maduro did announce some adjustments to the system. The essential items rate of 6.3 bolivares per dollar will stay the same, while he’ll merge the rates of 11 or 50 bolivares per dollar for other goods. Then he’ll create a new third rate to compete with the black market rate. His speech was short on details, but this appears to be a “stealth devaluation” that will give Venezuela more bolivares per dollar for exported oil.

Nevertheless, there’s obviously a problem when economists at companies like Nomura Holdings create indices like the Venezuela Screwed Up Index. The index is a kind of revenue-cost ratio that takes the real exchange rate into account. According to Nomura: “The lower the ratio, the more screwed up Venezuela is.”

5Venezuela Is Too Dependent On Oil Exports

Venezuela relies far too much on oil exports, which account for 96 percent of its export revenues. With benchmark crude oil prices dropping from $107 per barrel last summer to below $50 recently, the undiversified Venezuelan economy has been devastated.

To make matters worse, oil production is also down, falling from almost 3.5 million barrels a day before Chavez became President to around 2.6 million barrels a day now. That’s largely because Chavez diverted oil investment money into his social programs.

But even the oil that is being produced doesn’t bring in the money it should. About half is sold well below the market rate, either on the subsidized domestic market or through PetroCaribe. Another 360,000 barrels a day go to China for loan repayments. China may also get a discount on shipping costs.

During his international tour, Maduro tried to convince other OPEC members to curb production in order to raise global oil prices. But Saudi Arabia, the United Arab Emirates, and Kuwait refuse to lose market share. With enough money saved to withstand short-term pain, they’re hoping to use the current low prices to force US shale oil producers out of business. Unless that changes, Venezuela’s on its own.

4Venezuela Imports Almost Everything

Currently, Venezuela has to import almost everything, including basic goods like food. It even imports oil because the government shifted money from investment in oil production to social programs—lacking the money to properly upgrade its extra-heavy crude oil, the state oil company now has to dilute it with lighter imported oil just to transport it. The government tries to use its complex foreign exchange system to control prices. But this is now causing shortages of even the most basic items, like food, detergent, diapers, and toilet paper. That’s because few companies want to supply their products at artificially low prices.

Wealthy Venezuelans can put their money in US dollar accounts abroad to protect themselves from the rampant inflation that is steadily destroying the value of the bolivar. But poor people usually don’t have that option, so they trade scarce items among themselves or do business on the black market. Some of the shortages are also caused by corruption. For example, one trucker complained that he lost half his profits on cheese deliveries to bribes for police and inspectors.

Recently, consumers were limited to shopping one day a week at state-run stores. On that day, their purchases are limited to reduce the possibility of resale on the black market. But it’s believed that as many as two-thirds of the people are resellers anyway.

In some areas, customers are banned from standing in line at night. In other places, police are on duty to stop protests against the shortages and fighting among shoppers. These shortages are the worst Venezuelans have ever seen. As one consumer explained: “You can’t find anything. I’ve spent 15 days looking for diapers. You have to take off work to look for products. I go to at least five stores a day.”

3Government Policies Have Caused Hyperinflation

All these irresponsible governmental policies—from reckless spending on social programs to nationalization of industries to price controls via fixed foreign exchange rates—have caused hyperinflation in Venezuela. In the year ending November 30, 2014, Venezuela’s central bank reported inflation of 63.6 percent. That’s the easily the highest inflation rate in the region, if not the world.

But Steve Hanke of the Cato Institute thinks Venezuela’s inflation rate is actually closer to 183 percent if the currency black market is taken into consideration. Bank of America has predicted that the rate may surpass 1,000 percent in 2015 if Maduro doesn’t devalue the bolivar soon. Triple-digit inflation is almost a certainty. For now, it’s unclear exactly how Maduro’s recently proposed changes to Venezuela’s foreign exchange policy will impact the inflation rate.

We’ve already mentioned the shortages caused by this hyperinflation. Additionally, Venezuela’s fixed exchange rate meant that it didn’t receive enough bolivars per dollar for the oil it exported. As a result, the government has to print money to make up the difference and pay for spending at home. As Francisco Rodriguez from Bank of America says: “It turns into a vicious circle. Printing money leads to inflation, which leads to overvaluation, which leads to printing more money.”

On paper, the way to combat hyperinflation is to devalue the bolivar to its market exchange rate. That would reduce the risk of a debt default. But the real cost of consumer goods would rise dramatically because each bolivar would no longer buy as much. This would be especially harsh on Venezuela’s poor, making devaluation politically risky for Maduro.

2Maduro Lacks Access To Financing

Venezuela desperately needs cash. Oil revenues are falling, its allies aren’t loaning it enough, and it can’t tap international capital markets because it’s seen as a bad risk. In early January, Moody’s cut the credit rating of Venezuela’s government bonds to Caa3, seven notches below investment grade. Moody’s cited an increased default risk as the reason for the ratings change.

Maduro might want to consult with his fellow socialist, Ecuadorian President Rafael Correa, who was also a follower of Chavez. It’s hard to say whether Correa will ultimately take all the right steps for his country. But for now, he’s showing a willingness to step back from some policies that aren’t working, trimming Ecuador’s budget by around 4 percent in 2015. That equates to around 1.42 billion dollars in cuts.

A day after the announcement, China gave Ecuador a $5 billion 30-year loan with a 2 percent interest rate. Altogether, Ecuador landed $7.5 billion from China in loans and credit. Between budget cuts and the money from China, Ecuador can survive an oil price collapse below $40 a barrel. Earlier, Correa had received loans from the World Bank and Goldman Sachs. Moody’s also raised Ecuador’s rating to B3 from Caa1—the same level that Venezuela originally had. Maduro might want to take a lesson from that.

Venezuela has also sought help from China, but has ended up paying a steep price—much of China’s “investment” involves flooding Venezuela with Chinese products that compete with domestic goods.

1Default Could Get Messy

A default by Venezuela could turn ugly very quickly. For one thing, there are two different types of debt in play. The first is sovereign debt owed by the government of Venezuela. The second is debt owed by the state-run oil company, Petroleos de Venezuela SA (PdVSA).

PdVSA makes the money for Venezuela and has more property that might be seized in the event of a default. But it’s not at all clear what can be seized and by whom. Bondholders of sovereign debt have little chance of seizing PdVSA’s assets, including US subsidiary Citgo Petroleum Corp.

Many people think Maduro has the last word on default. In December, Maduro himself said that there was “no possibility of default, unless we would decide to not pay anymore as part of an economic strategy for development.” But that assumes the only type of default is a payment default. If Venezuela or PdVSA violate any other term of their agreements, they could automatically default. For example, in 2013, Ukraine agreed to a $3 billion loan from Russia, which came with the condition that Ukraine’s total debt should not exceed 60 percent of its GDP. When Ukraine’s level of debt exceeded the agreed-upon amount, Russia had the right to demand early repayment. Something similar could happen in Venezuela if an aggressive investor wants more favorable repayment terms.

Voting rights are also a complex topic, especially if different factions develop among the investors. With PdVSA, investors have to vote unanimously to change certain payment terms. But most of Venezuela’s sovereign debt permits a 75 percent majority to dictate restructuring terms for every investor in the same series of bonds. If aggressive investors form a 26 percent coalition, they would be able to block any restructuring moves. Argentina has spent years battling holdout investors of only 7 percent of its debt over a 2002 default.

And getting rid of Maduro doesn’t necessarily mean the country will avoid default. A new government could “repudiate” the existing debt (meaning they refuse to pay) by calling it odious or corrupt debt from the old government, or simply claim they don’t have the money to repay.