Crime

Crime  Crime

Crime  Movies and TV

Movies and TV 10 Movie Franchises That Started Dark but Turned Surprisingly Soft

History

History 10 Wars That Sound Made Up (but Absolutely Happened)

Movies and TV

Movies and TV 10 Movie Adaptations That Ruined Everything for Some Fans

History

History 10 Dirty Government Secrets Revealed by Declassified Files

Weird Stuff

Weird Stuff 10 Wacky Conspiracy Theories You Will Need to Sit Down For

Movies and TV

Movies and TV 10 Weird Ways That TV Shows Were Censored

Our World

Our World 10 Places with Geological Features That Shouldn’t Exist

Crime

Crime 10 Dark Details of the “Bodies in the Barrels” Murders

Animals

Animals The Animal Kingdom’s 10 Greatest Dance Moves

Crime

Crime 10 Criminal Masterminds Brought Down by Ridiculous Mistakes

Movies and TV

Movies and TV 10 Movie Franchises That Started Dark but Turned Surprisingly Soft

History

History 10 Wars That Sound Made Up (but Absolutely Happened)

Who's Behind Listverse?

Jamie Frater

Head Editor

Jamie founded Listverse due to an insatiable desire to share fascinating, obscure, and bizarre facts. He has been a guest speaker on numerous national radio and television stations and is a five time published author.

More About Us Movies and TV

Movies and TV 10 Movie Adaptations That Ruined Everything for Some Fans

History

History 10 Dirty Government Secrets Revealed by Declassified Files

Weird Stuff

Weird Stuff 10 Wacky Conspiracy Theories You Will Need to Sit Down For

Movies and TV

Movies and TV 10 Weird Ways That TV Shows Were Censored

Our World

Our World 10 Places with Geological Features That Shouldn’t Exist

Crime

Crime 10 Dark Details of the “Bodies in the Barrels” Murders

Animals

Animals The Animal Kingdom’s 10 Greatest Dance Moves

10 Quirky Facts About The IRS

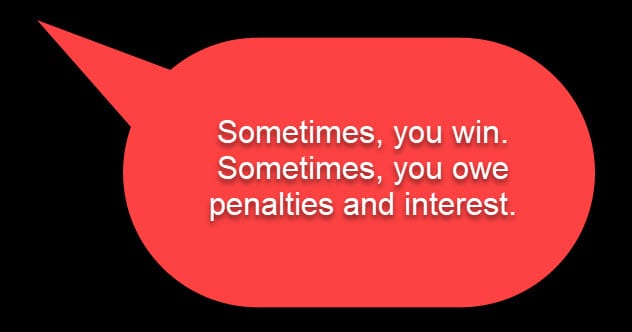

Another April 15 has just gone by. People who have filed their taxes can heave a sigh of relief while they await any tax refunds. People who have yet to file their taxes and haven’t requested an extension may be too late to avoid the interest and late payment penalties of the IRS.

However, there is more to the IRS than simply collecting taxes. They do some quirky things. As you’re about to find out, the agency is more interesting than it looks.

10 The IRS Uses Outdated Computers To Process Your Taxes

The IRS oversees one of the major revenue streams of the US government. So it is very surprising that the computers it uses to process our taxes are not up-to-date. They were made in the 1950s and still use magnetic tapes to store information.

Decades ago, every American manually filed their taxes. It was often time-consuming for IRS staff to cross-check for fraud and errors. This changed in the 1950s when the IRS contracted with IBM to develop the Individual Master File (IMF) computer software to hasten the tax process.

The software could automatically detect the differences between the incomes reported by employers and declared by employees. It also automatically compared current and previous tax payments to detect evaders. If that was not enough, it automatically issued letters to taxpayers who were determined to be underreporting their taxable income.

However, IMF is outdated. It was written in assembly programming language, which is not popular today. In fact, the IRS has more problems recruiting programmers to maintain the code with each passing year. The IRS has suggested replacing IMF with Customer Account Data Engine, but it has yet to do so.[1]

9 The IRS Only Offers One-Year Deductions And Credits For Kidnapped Children

For the 2018 tax year, the IRS raised the standard deduction and eliminated personal exemption deductions for dependents, such as children. Before that, however, the IRS had elaborate tax exemption rules for the parents of kidnapped children.

The IRS only allowed tax deductions for a child kidnapped by someone other than a family member. The child must have lived with the parent or guardian claiming the deduction for half the year during which the youngster was kidnapped. (For tax year 2018, this rule still applies if you want to claim an earned income tax credit.)[2]

The parent or guardian was only eligible for a personal exemption deduction for the kidnapped child for the remainder of the year and not even a day after. The IRS said that it could not allow tax deductions after the year of abduction because parents could only claim personal exemption deductions for the youngster if they provided half of the child’s upkeep.

Interestingly, the kidnapper—even if he was a family member—could not legally claim a tax deduction for the upkeep of the child, either, because the kidnapper had the child illegally.

8 The IRS Made Seven Million American Children Disappear In 1987

The IRS has not always required parents to list the social security numbers of their children on tax returns. Many parents exploited the loophole and listed nonexistent children as dependents. It was almost impossible for the IRS to detect or even confirm whether the children really existed.

This changed in 1987 when the IRS demanded that parents list the social security numbers of any dependents who were at least five years old. The rule came into force in 1987 when US parents listed 70 million children as dependents. Curiously, they had declared 77 million children as dependents a year earlier. Where did the seven million children go?[3]

7 The Church Of Scientology Allegedly Blackmailed The IRS To Become Tax-Exempt

The Church of Scientology does not pay taxes to the US government even though it has some profitable sources of income. The IRS claimed that the church made $300 million a year in the early 1990s. It probably makes much more now.

Interestingly, the Church of Scientology paid taxes to the US government for 25 years until the IRS suddenly declared it a tax-free enterprise in October 1993. Before then, the IRS and the church had been engaged in a long legal battle over the church’s tax status.

The church declared that it was not a taxable entity because it was a church. The IRS insisted that it was actually a business and its income was taxable. However, the church continued to pay the taxes because every court considered it a business—until the IRS suddenly backtracked in 1993. The IRS has never revealed the reason for its surprising change of mind.

It was later revealed that the Church of Scientology was granted tax-exempt status after it allegedly launched an elaborate blackmail attempt against several key IRS staff members. Supposedly, the Church of Scientology hired private investigators to gather dirt about IRS officials and their businesses. It may have also secretly funded some anti-IRS organizations.

In 1991, David Miscavige, the leader of the church, met with Fred T. Goldberg Jr., then the commissioner of the IRS, and offered to abandon several lawsuits the church was filing against the IRS in exchange for tax-exempt status. However, neither Goldberg nor Miscavige have confirmed that this is true.

The church stated that the meeting was impromptu and denied that its private investigators had something to do with it. The IRS still refused to release the information about the meeting even after The New York Times invoked the Freedom of Information Act.[4]

6 The IRS Has An Elaborate Plan To Resume Tax Collection A Month After A Nuclear War

The IRS is so hell-bent on collecting taxes from US citizens, residents, and businesses that it has even outlined how to do so after a nuclear Armageddon. As reported in 1989, the IRS updated its employee manual with information detailing the agency’s response to a nuclear war.

This was during the Cold War, so the fear of a nuclear apocalypse was somewhat understandable. According to the manual, the IRS will resume tax collection within 30 days of a nuclear attack. Considering the chaos, every staff member will focus on this important job despite their position.

Tax collection efforts will be concentrated on areas that produce the most taxes. The manual also mentioned that staff will focus on collecting current taxes because the widespread destruction could make it challenging to recover previously owed taxes.[5]

5 A Commissioner Of The IRS Was Convicted For Tax Fraud

The commissioner of the IRS is the agency’s head. He is supposed to be the most upright about tax matters, but that may not always be so. Decades ago, Joseph D. Nunan Jr., the IRS commissioner from 1944 to 1947, was sentenced to five years in prison and ordered to pay a $15,000 fine for tax fraud.

Nunan’s problems began in March 1933 when he withdrew large sums from his bank (over concerns that the bank would collapse) and kept the money in his home. This money couldn’t be tracked. When he later deposited money in other banks, it was unclear if he was depositing new income or these previously withdrawn funds. In 1948, he also won a $1,800 bet after correctly predicting that Harry S. Truman would defeat Thomas E. Dewey in that year’s presidential election.

On tax returns from 1946 to 1950, Nunan also hid a series of fees he received for legal services he offered through his firm. He neither declared nor paid taxes on this income. The IRS believed that he dodged paying $90,000 in taxes over five years.[6]

Nunan desperately tried to avoid jail time after he was exposed. He claimed that the monies were nontaxable even though they were. He also denied that he was an expert in tax matters even though he was. He stated that he only got the IRS job because of politics.

4 The IRS Taxes Proceeds From Crime

The IRS requires US citizens, residents, and businesses to pay taxes on the proceeds of crime. Bribes, kickbacks, and other monies generated from illegal activities, including theft and illegal drug sales, are considered taxable income.

The IRS also demands that thieves who steal taxable nonmonetary items pay the appropriate tax based on the “fair market value” of the stolen item. Thieves are only exempted from paying the tax if they return the snatched item to the owner in the year it was stolen.

Ordinarily, a tax on illegal income would have gone afoul of the Fifth Amendment, which protects criminals from incriminating themselves. However, the IRS has this covered. Criminals are allowed to pay their taxes without listing the source of the income. An illegal drug dealer could just list himself as “self-employed.”[7]

3 The IRS Has An Armed Division

The IRS Criminal Investigation Division is the armed department of the agency. Workers in the department call themselves “special agents,” the same title used by FBI agents. IRS special agents use a wide array of weapons, including machine guns.

As of 2017, it was reported that the IRS Criminal Investigation Division had 4,487 guns and over five million rounds of ammunition. The IRS only maintains the arsenal to provide its agents with the required weapons when executing search warrants and arresting suspected tax evaders.

However, it seems that IRS special agents do not get to shoot their guns often. Between 2009 and 2011, it was determined that the IRS special agents accidentally fired their weapons a total of 11 times, which is more than the number of times they intentionally fired their weapons.[8]

2 The IRS Maintains A List Of Violent Taxpayers

Not everyone likes paying taxes. Some citizens even oppose these payments and may become violent when the IRS comes knocking on their doors. Violence against the IRS rose sharply in the 1970s when radical citizens opposed to taxation started targeting IRS staff members and offices in what would be considered acts of terrorism.

Citizens opposing taxation have attacked or kidnapped IRS agents. Some people who owe taxes have even hired assassins to get rid of IRS staff members. Others have shot at or just driven vehicles into IRS offices. There have also been a series of failed attempts to blow up or burn down IRS offices.

In 1991, the IRS submitted a list of people it considered “potentially dangerous taxpayers” to the police and other law enforcement agencies. However, attacks against the IRS continued.[9]

The attacks reached their peak in 2010 when Joe Stack flew an airplane into the IRS office in Austin, Texas. Stack and an IRS agent were killed. Thirteen other people were injured. This was the deadliest attack against the IRS.

1 The IRS Has An Entire Page Dedicated To Tax Quotes

The IRS dedicates an entire page on its website to publishing tax quotes. The quotes seem to be directed at encouraging people to pay their taxes.

There are quotes like “Taxes are what we pay for civilized society” by Justice Oliver Wendell Holmes Jr., “The power of taxing people and their property is essential to the very existence of government” by President James Madison, and “Like mothers, taxes are often misunderstood, but seldom forgotten” by Lord Bramwell.

There are also quirky tax quotes like “I am proud to be paying taxes in the United States. The only thing is—I could be just as proud for half the money” by Arthur Godfrey, “Few of us ever test our powers of deduction, except when filling out an income tax form” by Laurence J. Peter, and “Next to being shot at and missed, nothing is really quite as satisfying as an income tax refund” by F.J. Raymond.[10]

Other tax quotes are “People who complain about taxes can be divided into two classes: men and women,” which was credited to an unknown author, “The best measure of a man’s honesty isn’t his income tax return. It’s the zero adjust on his bathroom scale” by Arthur C. Clarke, and “Income tax has made more liars out of the American people than golf” by Will Rogers.

However, for some reason, the IRS left out the best tax quote of all: “In this world, nothing can be said to be certain, except death and taxes” by Benjamin Franklin.

Read more quirky facts about taxes on 10 Of The Richest Tax-Exempt Organizations and Top 10 Ridiculous Taxes Some Countries Impose On Their Citizens.